- Ziggurat Realestatecorp

- Aug 31, 2023

- 2 min read

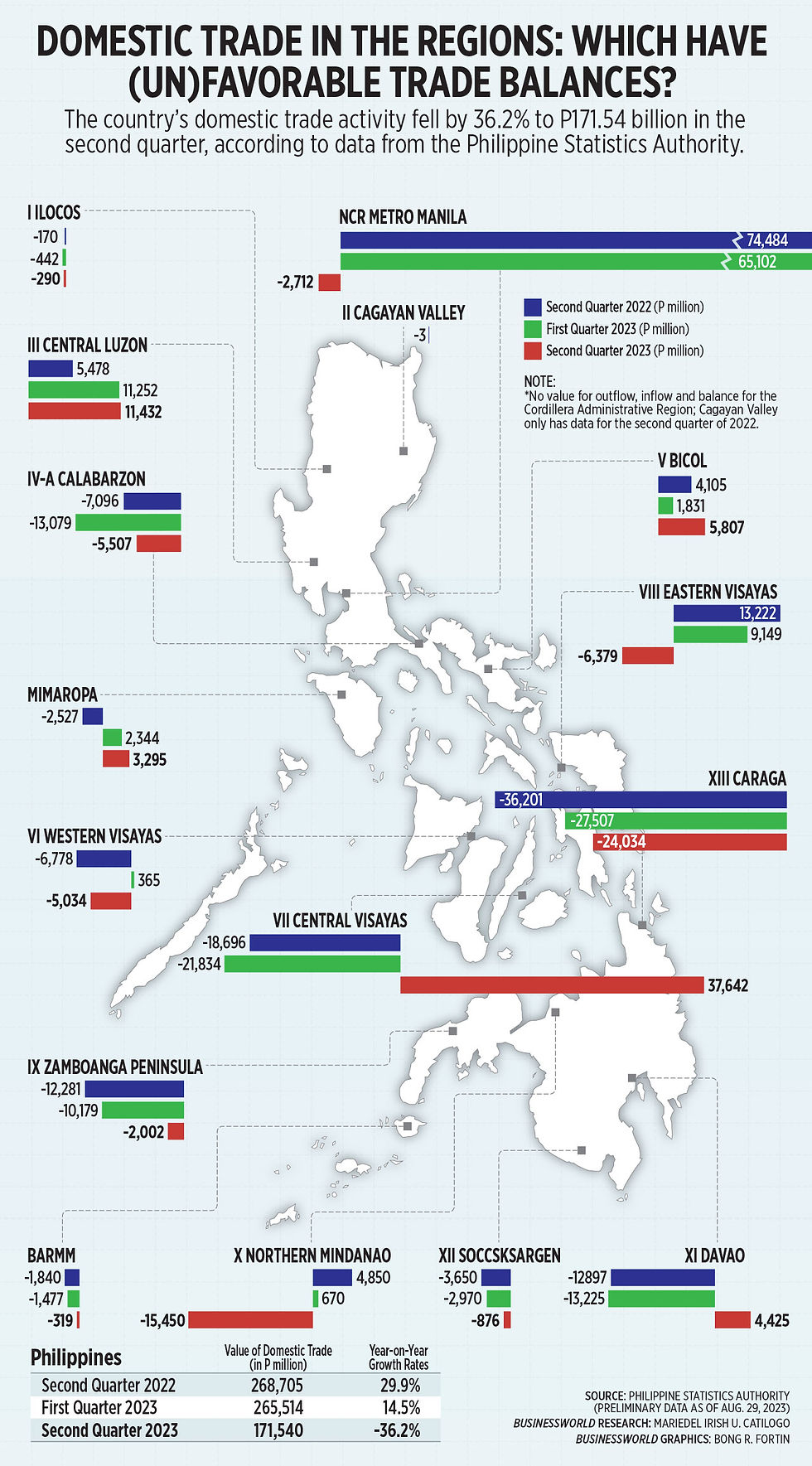

The domestic trade in goods declined by an annual 36.2% in the second quarter, the Philippine Statistics Authority (PSA) said.

Preliminary data from the PSA’s Commodity Flow in the Philippines report showed the value of goods traded in the three months to June dropped by a third to P171.54 billion from P268.7 billion in the same period in 2022.

Quarter on quarter, domestic trade fell by 35% from P265.51 billion in the first quarter this year.

The second-quarter decline was a reversal from the 29.9% growth in the same period in 2022, and the 14.5% growth in the previous quarter.

In terms of volume, domestic trade inched up to 5.79 million tons in the second quarter from 5.73 million tons in the same period in 2022. Quarter on quarter, it fell by 10% from 6.45 million tons in the January-to-March period.

Commodity flow includes all goods transported by water, air, and rail transport. Nearly all (99.96%) of the commodities were transported through water.

ING Bank N.V. Manila Senior Economist Nicholas Antonio T. Mapa attributed the decline due to base effects.

“We’re now likely seeing more normalized levels of trade. This mirrors the negative quarter-on-quarter gross domestic product (GDP) growth posted in the second quarter suggesting economic activity is slowing,” Mr. Mapa said.

In the second quarter, GDP expanded by 4.3% in the second quarter, weaker than the 6.4% growth in the first quarter and the 7.5% print a year ago. This was also the slowest in over two years.

Quarter on quarter, GDP shrank by 0.9% in the April-to-June period, a reversal of the 1.1% growth in the first quarter.

PSA data showed the trade value of eight out of the 10 commodity categories fell year on year in the second quarter.

The trade value of animal and vegetable oils, fats and waxes recorded the biggest annual decline (-90.8% from -47.2%), followed by beverages and tobacco (-82.9% from 4.1%), miscellaneous manufactured articles (-67% from 14.6%), chemicals and related products (-62.1% from 20.3%), food and live animals (-58.5% from 14.3%).

Other categories that recorded declines were machinery and transport equipment (-26.1% from 27.4%), manufactured goods classified chiefly by material (-20.6% from 1.1%), and commodities and transactions not classified elsewhere in the PSCC (-19.7% from -1.5%).

Meanwhile, the trade value of crude materials (inedible except fuel) jumped by 171.2% in the second quarter, while mineral fuels, lubricants and related materials rose by 13.2%.

In the second quarter, machinery and transport recorded the biggest value of traded commodities at P61.51 billion, but this was 26% lower than the P83.27 billion recorded a year ago.

Central Visayas was the top source and destination of traded commodities in the April-to-June period with total outflows amounting to P95.61 billion and inflows worth P57.97 billion.

Central Visayas also had the largest trade balance in the second quarter with P37.64 billion, followed by Central Luzon with P11.43 billion and Bicol with P5.81 billion.

Three regions had the biggest negative trade balance, led by Caraga (-P24.03 billion), Northern Mindanao (-P15.45 billion) and Eastern Visayas (-P6.38 billion).

Source: Business World