- Ziggurat Realestatecorp

- Dec 25, 2023

- 3 min read

Colliers Philippines has been seeing exciting and innovative developments in the Philippine real estate investment trust (REIT) sector.

Property firms are maximizing REIT benefits and we see more property firms utilizing REITs to fuel their expansion within and outside Metro Manila as well as extend their exposure into other property segments.

The Philippine REIT market is primed for further diversification and developers should be on the lookout for other assets that can be divested into their REIT companies.

Colliers believes that the further diversification of the Philippine REIT market bodes well for property firms, investors, and the Philippine property market in general.

Moving forward, Colliers sees an aggressive expansion of REIT companies in the Philippines. We even see some firms exploring the feasibility of divesting other asset classes including business parks, data centers, as well as co-working and co-living facilities. We even recommend that firms explore the viability of infrastructure and renewable energy projects.

In our view, further expansion and diversification of the Philippine REIT landscape is likely to benefit the country’s infrastructure development plan. We even see it supporting the Marcos administration’s push to ‘Build, Better, More.’

REIT firms and stakeholders should be mindful of the regulatory environment that they are operating in and should be updated of the proposed amendments to the REIT Law and how new measures and provisions are likely to stall or advance the sector.

Colliers encourages property firms to further test the market to capture opportunities from a constantly evolving and developing Philippine REIT sector. Diversification will be the name of the game.

Colliers encourages the government to be more supportive of developers’ REIT undertaking. The challenge for lawmakers and members of Executive department is to foster an accommodating and inclusive regulatory framework to ensure that Philippine REITs become among the most competitive in the region. The advancement of Philippine REIT should not be stalled by any regulatory gridlock.

MONITOR REIT LAW AMENDMENTS

The House of Representatives has approved on third and final reading a bill seeking to amend the REIT Law of 2009. The bill’s features include requiring REITs to reinvest their proceeds “within one year from receipt of proceeds realized by the sponsor or promoter.” REITs are also required to submit a reinvestment plan to the Securities and Exchange Commission and Philippine Stock Exchange and secure a certification annually to prove that it is compliant with its reinvestment plan.

Colliers encourages REIT developers to constantly monitor the progress of these proposed amendments. A counterpart bill has yet to be filed in the Senate.

DIVERSIFY PORTFOLIO

Developers with REIT firms have been divesting other asset classes into their REIT vehicles to take advantage of the property market’s rebound. At the height of the pandemic, developers only divested office assets. As the government relaxed COVID-related restrictions and more economic segments reopened, other property sectors such as retail, hotel, and industrial also saw gradual recovery, making them viable asset classes to be utilized for REIT listing.

Non-traditional asset classes such as infrastructure projects (including toll roads), cold and self-storage facilities, data centers, and hospitals can also be infused into the property firms’ REIT vehicles to further attract more investors.

Developers should also explore the viability of other asset classes that generate recurring income such as co-working spaces and co-living facilities. Firms in other Asian countries even infuse business parks into their REITs and the feasibility of this asset class should also be explored moving forward.

ASSESS OPTIMAL REIT PORTFOLIO MIX

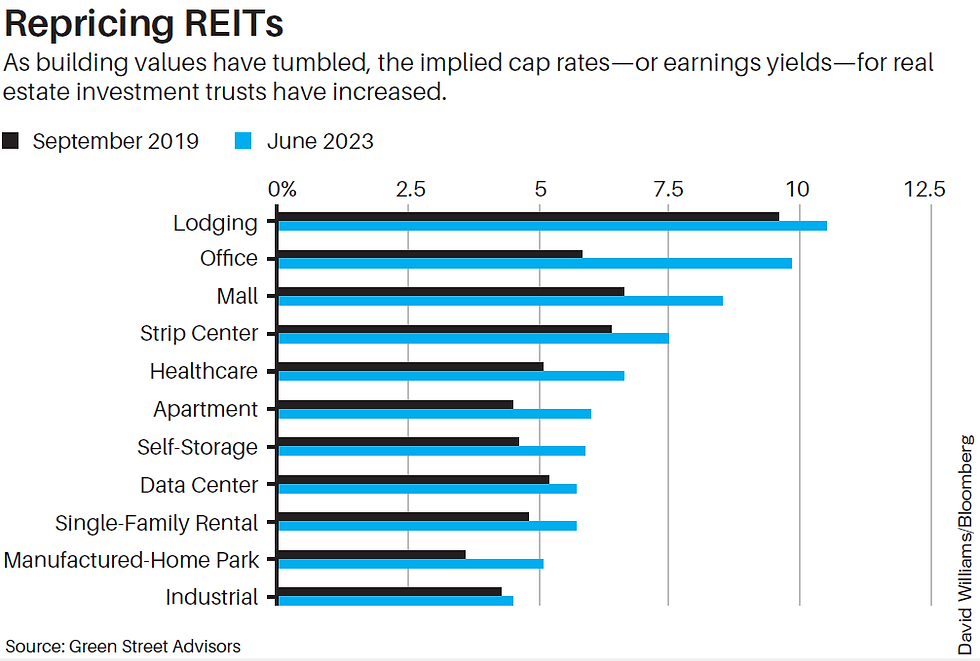

Colliers believes that developers should assess the ideal portfolio mix that will provide the optimal yield for investors. Property firms should consider divesting asset classes that will provide highest dividend to investors based on these asset classes’ performance in the market.

Office and industrial are usually part of developers’ portfolio mixes but property firms should also look at other viable assets in the future, including retail and hotel.

LAUNCH OF RETAIL REITs

Colliers believes that property developers with retail footprint should consider divesting malls into their REIT portfolio especially now that the retail segment is recovering.

Malls generate recurring income and are now a viable REIT asset class as vacancies are declining and lease rates are starting to increase.

In our view, developers should carefully assess which retail outlets to add to their REIT portfolio and should consider projected mall space absorption as well as profiles of retailers willing to take up brick-and-mortar spaces.

Developers should take advantage of renewed interest from foreign retailers as well as continued growth of Philippine economy, mainly driven by personal consumption.

Source: Business World